BRAIN BEFORE POST

Michèle Trebo

The Bitcoin Lightning Network as the World's Main Means of Payment

A cryptocurrency is a digital or virtual currency that secures transactions using cryptography, specifically blockchain or other digital signatures. Since the market is subject to constant fluctuations, the prices of cryptocurrencies are also volatile. This is also the reason why many traders do not recognize cryptocurrencies as a means of payment. The market is too uncertain for them. In the meantime, various service providers have taken on this market niche. These take over the payment processing with cryptocurrencies and offer the merchants a current exchange rate at that time. This reduces the risk of exchange rate fluctuation. The main difference with normal money is that no issuing or regulatory authority exists. The government and financial institutions have no influence. So a crypto payment does not go through a central computer system, but through a decentralized system that does not rely on banks to verify transactions.

A blockchain is a distributed, public database. In the context of Bitcoin or other cryptocurrencies, this technology is used in the form of a decentralized database to manage asset transactions. Thus, almost anything of value can be tracked and traded using a blockchain network. This significantly reduces risks and costs for all parties involved. Blockchain is of great importance. The faster information can be transmitted and the more accurate it is, the better. Blockchain provides information instantly, collectively usable by the users of a network, and transparently. Because all users can access truthful details of a transaction end-to-end, trust is greater, efficiency increases, and new opportunities open up. An ordinary bank payment is usually processed through a central computer system. In this case, you have to trust the provider of this system with your sensitive data. With a blockchain, on the other hand, you don’t enter a transaction with your name, but with the so-called public key, which consists of a long sequence of letters and numbers. A transaction, unlike an ordinary bank payment, is synchronized across the computers of all blockchain participants. Before a transaction is completed, it must be stored in a block visible to all users. This happens differently depending on the type of blockchain.

Bitcoin is one of the most well-known cryptocurrencies in the world and is based on the Bitcoin blockchain. In the Bitcoin network, the creation of a block can basically be carried out by any blockchain user, referred to in this case as a miner. This involves using a mathematical function to calculate accumulated transactions to a block. The miner who calculates the block first receives a so-called mining reward in the form of a predefined number of bitcoins. This creates a competition between the miners. Once the block has been calculated, it is stored unchangeably on different computers. The calculation of these blocks requires high computing power, a lot of electricity and is thus not particularly ecological. Another problem is that only a certain amount of storage space is available for transactions per block and, by definition, a block is created approximately every 10 minutes. This means that, depending on the workload, not all transactions will find space in the next block. This leads to delays in the payment process. Although Bitcoin is considered anonymous, it is possible to draw conclusions about the identity of a person based on the public key. The public key cannot be clearly assigned to a specific user. In addition, there is no central register that provides information about the owner of a public key. This is different with the cryptocurrency Monero, which additionally encrypts its transactions and thus the transaction details cannot be viewed. This achieves a higher degree of anonymization.

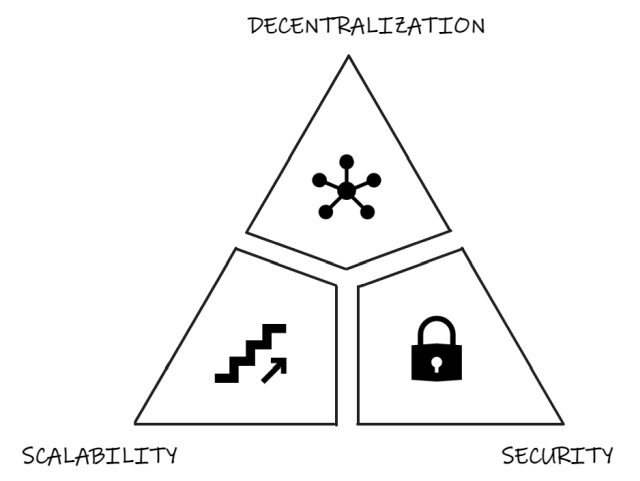

In the context of cryptocurrencies and thus also Bitcoin, the so-called blockchain trilemma is often referenced. The three competing areas are scalability, decentralization, and security. Since they are opposites, they are in constant competition, which means that increasing one area necessarily comes at the expense of the others. In the Bitcoin example, high decentralization and high security are implemented – but scalability suffers as a result. If you want to increase scalability, you have to make sacrifices in the area of security or greater centralization.

Thus, Bitcoin can ensure a censorship-resistant network with immutable rules and the lowest possible attack vectors. However, the scalability problem must be neglected. The bitcoin network handles only seven transactions per second. If there is a higher usage, the fees also increase. Since there is not enough space for all transactions in a block when the usage is high, there is a competition, which is fought out via the amount of the fee. This makes smaller payments or micropayments uneconomical. If every node in the network needs to know about every transaction taking place, this can significantly slow down the network’s ability to capture all global financial transactions. Transactions should be able to be captured in a way that does not compromise decentralization and security. To address the issue of limited number of transactions and the associated increasing transaction fees without sacrificing security and decentralization, the Bitcoin Lightning Network was developed.

A lightning network increases transaction throughput per second. The idea of lightning networks is that if two users are interested in a transaction, all other nodes need not know about it. The Lightning network enables peer-to-peer payments that occur outside the Bitcoin blockchain through payment channels between individuals. Once the parties close their channels, an accounting takes place to clarify who owns what. The Lightning network can thus execute millions of transactions per second and is nearly fee-free. This network is a peer-to-peer mesh network in that each node is equal (with no central authority) that uses Bitcoin consensus rules to complete transactions. In the document The Bitcoin Lightning Network, the basic idea is explained as follows. If no one hears the falling of a tree, it doesn’t matter if the falling makes a sound or not. It works similarly with the blockchain. If only two users are interested in a recurring transaction, not all other nodes in the Bitcoin network need to know about it. It is better if only the absolute minimum of information is in the blockchain. By postponing telling the whole world about every transaction, you allow users to do many transactions without bloating the blockchain or creating trust in a centralized counterparty.

In order for a transaction to be executed over the Bitcoin Lightning network, a payment channel must first be opened between the sender and receiver. This payment channel is a multisignature address used by the Bitcoin network. Both the sender and receiver must sign if a transaction is to be sent from the multisignature address. To open a payment channel, a finance transaction is more accurately added to a regular transaction on the blockchain. It is necessary to specify how many Satoshis should be in the payment channel. Satoshis can be used to send as many transactions back and forth as you want, as long as there are satoshis in the channel. The payment channel keeps track of users’ account balances. Creating a transaction always has two outputs. If you have 100’000 Satoshis in the channel and you want to send 10’000 Satoshis to the recipient, you will get 90’000 Satoshis and the recipient will get 10’000 Satoshis. Only when both have confirmed the transaction, the account balances are adjusted. Apart from the participants themselves, no one can allocate this peer-to-peer transaction. Only when the channel is closed are the final account balances publicly written back to the Bitcoin blockchain.

What if a transaction is to go to a recipient with whom no payment channel has been established? At most, someone with whom a channel exists has a payment channel with the requested recipient. So, one can send his channel partner the requested amount within the established payment channel and he will forward the amount to the requested final recipient. The network becomes polynomially more useful the more nodes involved. To make the effort pay off for the intermediary_, it can charge a fee called a routing fee. Thanks to the hash-time-lock contract, which allows time-bound transactions to be carried out, counterparty risk can be eliminated. This means that the recipient of a transaction must confirm the payment by cryptographic proof within a certain time frame for the transaction to occur. Exactly whose channels are used is unknown. This is because everything is handled via onion and host privacy technologies.

All relevant numbers like nodes, channels and the capacity are increasing steadily. The Lightning network is no longer the future, but already determines the present. This is also shown by the visualization of nodes and channels on LnRouter. More and more companies are starting to accept Bitcoin, with the infrastructure provided by the Lightning network playing a crucial role. Moreover, the Lightning network can also be implemented on other cryptocurrencies. The only conditions are multisignature function and hash-time lock contracts. The Lightning network enables real-time currency exchanges with no fees and within one second. Through Sphinx, a real-time chat, Lightning technology not only allows messages to be sent completely invisible to outsiders in a decentralized manner, but also allows payments to be made instantly. The Lightning network is also revolutionizing other areas such as Twitter, gift certificates (Bitrefill and Fold) or payments via devices that accept Visa debit cards (Moon). Something that is not currently possible with the banking system is money streaming. This allows a payment to be made every second, opening up possibilities for future business models. This list is not exhaustive and is growing.

The Lightning network is not free of problems. These are technically challenging, but not unsolvable. One problem is the liquidity of the channels and the associated limits. It is counterintuitive that a payment channel must first be filled with liquidity before a transaction is even possible. Only if there are enough nodes that have enough liquidity can the system work. Further risks are so-called supernodes or hubs, which can act like banks and thus endanger decentralization. Furthermore, a potential danger is the almost fee-free transactions, which lead to miners earning less and thus the base (underlying Bitcoin blockchain) is endangered. This means that the market must find a balance between what is settled via the lightning network and what is settled via the blockchain. Further, it can be difficult to find a fitting route. The more nodes and liquidity there are, the lower the risk of routing failure. On the other hand, the Braess paradox states more broadly that the more nodes are added, the slower the flow through the network. Further, Lightning nodes must (almost) always be online. Furthermore, attackers are difficult to identify because it is not known who is sending money to whom. A wide variety of attacks on the network are possible, which affects security. Many problems are currently not even known; these will only come to light over time. However, one can be confident that solutions will be found, as specialists are dealing with this on a daily basis.

Cryptocurrencies are digital or virtual currencies and are based on blockchain technology, including one of the most well-known cryptocurrencies Bitcoin. Because a transaction is shared with all users located on the network and requires a lot of computing power, a block is only created about every 10 minutes, and the number of transactions per block is limited, it takes a long time to complete a transaction. As a result, fees increase. Because all users can see the transaction details in the blockchain, payment flows can be followed and traced back to participants. The Bitcoin Lightning Network solves especially the mentioned weaknesses of classic Bitcoin payments like the long waiting time and high fees. For this purpose, so-called payment channels are opened between two parties and all further payments are made off-chain on a new network (the Lightning Network). Only when the parties want to close the channel, the final balances are synchronized again with a transaction on the Bitcoin Blockchain. The Bitcoin Lightning Network is still in an experimental phase and has some problems as well as attack possibilities. However, these are not unsolvable. Specialists are working on their solution on a daily basis. The network is not only applicable to Bitcoin, but also to other cryptocurrencies that have the multisignature function and hash-time-lock contracts. In a few years, it is quite conceivable that the Lightning network will act as the main global means of payment.

We are going to monitor the digital underground for you!

Michèle Trebo

Michèle Trebo

Michèle Trebo

Michèle Trebo

Our experts will get in contact with you!